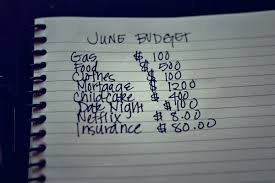

1. Avoid Overspending

One of the most significant issues with credit cards is that they can lead to overspending. Many people use their credit cards to purchase items they cannot afford “quite yet”, and as a result, they accumulate debt. If you want to use your credit card smartly, you should avoid buying anything you cannot afford to pay off in full when your statement arrives. It’s called spending without a plan. Many people have lost their home because of poor credit card and budget management.

Credit cards extend money for purchases for a period and then you pay them back, either all at once or on a payment plan. A good rule is if you don’t know how you are going to pay the money back, don’t buy it. In my opinion, Credit cards should only be used for emergencies or as an investing tool. In this case, investing means making your wealth grow by increasing in value over time or cutting outgoing expenses. If I have a car loan at 12% and a credit card at 9% APR, I will pay off that car loan with my credit card. I just saved 3%.

3. Treat Your Credit Card Like a Debit Card

One way to use your credit card smartly is to treat it like a debit card. If you use your credit card for a purchase, be sure to record it in your checking account registry. That way, you won’t spend the money you need to pay off your credit card balance elsewhere. At the end of the month, you can pay off your credit card statement in full, knowing that you have the money to do so. If you can’t pay off the statement balance, don’t buy anything new until you do; Here’s why.

4. Pay Your Balance in Full Each Month

Many credit cards offer a grace period of approximately 28 days interest-free on purchases. This means that if you pay off your balance in full at the end of the month, you won’t pay any interest on your purchases. Additionally, paying your balance in full each month can help boost your credit score. However, be sure to check for any maintenance fees your credit card company may charge.

Now, Before going any further, some credit card companies have gotten wise to this and have started charging interest right after the date of purchase, so read your credit card contract to learn the terms you are agreeing to.

5. Use Your Credit Card to Pay Bills

Another smart way to use your credit card is to pay your bills with it. By doing so, you can earn cashback rewards while leaving your income in your Checking account. This also helps bust your credit score by using your credit card on monthly bills.

Now for the bonus trick. If you read my article on “Line’s of Credit”, here is a bonus trick to help with that. I told you the longer you leave your money (income) in the LOC, the more interest gets canceled, right? This method cancels more interest on the LOC, leading to more savings and a lower “effective” interest rate. Now, Pay the household bills with the credit card while you leave your income in the LOC all month long. Then pay off the credit card at the end of the month with one payment from the LOC.

Use of the credit card stays interest free and it cancels a lot more interest on the “Line Of Credit”. Plus you earn more cash back rewards on the credit card (if your card is on that program). If the balance of the LOC is not going down each month, check your numbers. You’re spending too much.

Use Credit Cards for Emergencies and Investments

While credit cards can be tempting to use for everyday purchases, they should be reserved for emergencies and investments. For example, if you have a car loan with a high-interest rate (ex. 16%), you can pay it off with a credit card with a lower interest rate (ex. 0% introductory rate for 12 months). This way, you’ll save money on interest payments.

At least make sure to keep your credit card in check. They are good tools, but can get you in trouble in a hurry. For more ideas on fixing your finances, go to our blog.

We help people in real estate trouble. We buy houses and give free advice to people that just need a little help.

Good luck

Other related articles;

- Georgia real estate blog

- Fix your finances or sell your house

- Sometimes you need an agent

- Prepping your house for sale